The dust has settled on BFCM 2018, and most retailers are seeing dollar signs. In short, it was a record year for Cyber Week spending, particularly on mobile. Sales reached all time highs, leading retailers won big with omni-channel strategies, and consumers proved they knew what they were looking for long before the holiday began. There’s a lot of data to sort through, so we’ve aggregated the finer points on how it all went so that you can apply these insights to your BFCM strategy in 2019. Starting with sales by day, then the channels these sales took place in and how consumers got there, followed by the top products of BFCM this year, and finally our key takeaways, let’s talk about Black Friday / Cyber Monday 2018.

BFCM 2018: Big Spending

Overall, the 5 days from Thanksgiving to Cyber Monday saw record-breaking sales, particularly online. Brick + mortar stores are certainly not out, with a growing trend in buying online and picking up in-store (BOPIS). Across the board, consumers are looking for customized shopping experiences best suited to their schedules and holiday plans. Retailers that created the most opportunities for consumers to shop via cross-channel capabilities tended to lead the pack in holiday sales.

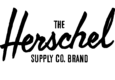

BFCM Sales by Day

In terms of spending, Cyber Monday made history as the highest U.S. e-commerce sales day ever topping out at $7.09B. Additionally, Amazon reported selling more items on Cyber Monday this year than any other day in its history including all of its Prime Days. Black Friday rounded out second place for daily sales with $6.20B. Small Business Saturday, created by American Express in 2010 to encourage spending at small and local companies, continues to grow. Worth noting however, Adobe qualifies “small retailers” as companies selling less than $1B/year, a number significantly higher than the amount the majority of local businesses brings in annually.

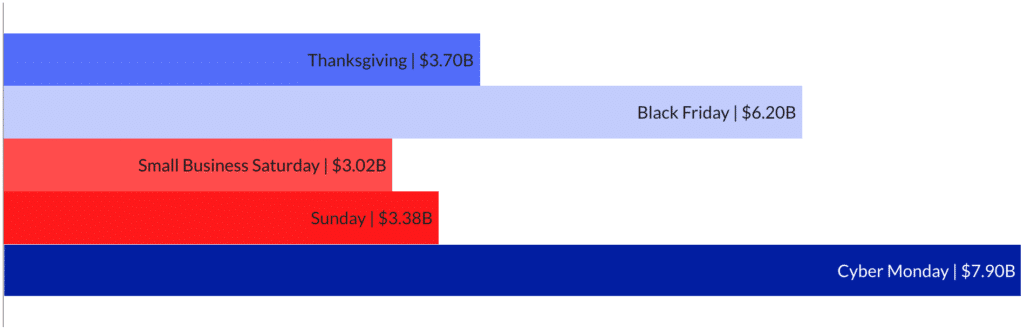

BFCM YoY Growth Rate

It may not have a dedicated nickname, but the 4th day of BFCM is becoming an integral part of the overall holiday spendathon. Black Friday Creep refers to the noticeable growth in daily spending YOY on every day leading up to Cyber Monday. This year in particular, online sales increased more on Thanksgiving, Small Business Saturday, and finally on Sunday than they did on Black Friday and Cyber Monday.

Changing Lanes

Multi-channel shopping, including both online and in-store experiences was the preferred route to purchase for the majority (54%) of consumers this year, according to the NRF. Today’s consumer wants to be able to oscillate between online and in-store, desktop and mobile throughout the purchase journey. Retailers who support omni-channel experiences reaped the rewards with increased consumer confidence at the product level, often well before the holiday arrived, leading to more purchases throughout BFCM.

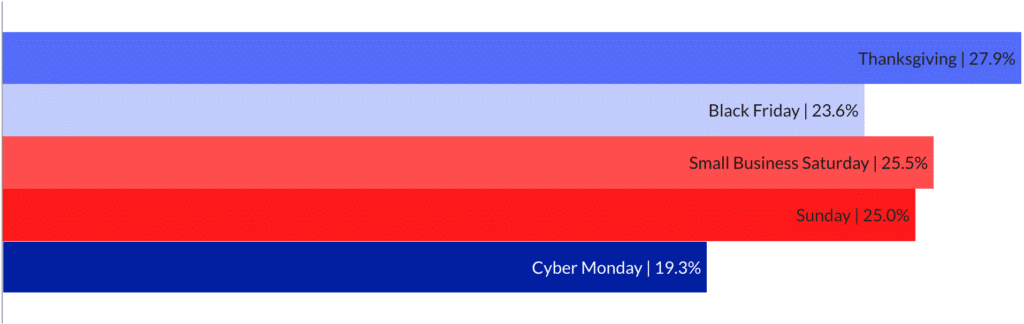

BFCM Referral Traffic

In terms of online source, most shoppers went directly to the site they were intending to purchase from. This means the research process likely began long before Thanksgiving. Paid search accounted for the next majority of site traffic, followed by organic search, then email. Email is relatively inexpensive as a marketing initiative compared to paid and organic search efforts, so the level of traffic being driven by email here is well worth noting. Social media did poorly, but that doesn’t mean it should be discounted entirely.

Device Matters

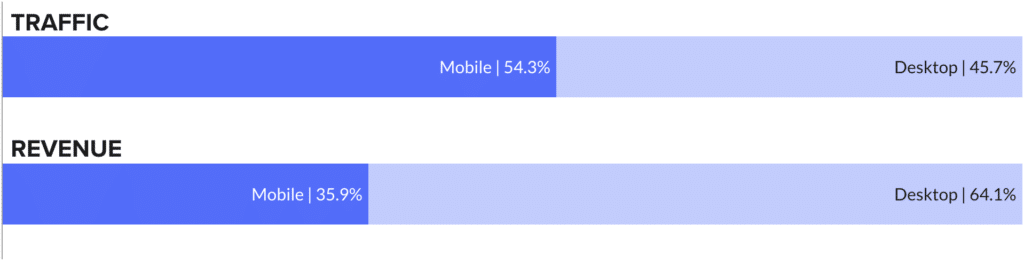

Mobile shopping increased this year by nearly 19%, with visits split between smartphone (46.6% ) and tablet (7.7%). Revenue on mobile also increased by 18.3% since last year. Furthermore, Shopify reported a whopping 66% of all sales on the Shopify platform as occurring on mobile.

Winning Products

According to retailers, the most popular products during BFCM this year were electronics, namely televisions and computers, and toys. Adobe reported the top selling products across all 4 major days as follows:

- Nintendo Switch

- Fingerlings

- L.O.L. Surprise

- Laptops

- Little Live Pets

As mentioned earlier, most consumers found their way to purchase via direct search, meaning the research process, or buying intent, began long before the holiday sales. In a Salesforce report, it was found that buying intent increased by 22% in Q3 2018, a 21% increase over Q3 2016.

Today’s holiday shoppers are much more confident about what they are buying and from where well before they make the actual purchase.

A few major retailers experienced inventory and technical hiccups during BFCM. The Nintendo Switch (most popular product this season) was out of stock at Target and Gamestop by the end of Thanksgiving. The Playstation 4 and Instant Pot also sold out at Walmart and Target on Thanksgiving. Additionally, multiple major websites crashed due to heavy traffic, including Walmart, Ulta, Lululemon, J Crew, Lowes, and JD Sports. While the crashes were temporary, they did major damage. Walmart, for example, resolved their site issues in about 150 minutes, but during that time, 3.6 million shoppers were affected, costing Walmart an estimated $9 million in lost sales.

Key Takeaways

BFCM 2018 is over, but the holiday season has just began. There’s still time to apply these learnings to the rest of the year. So what did we learn?

Mobile Is In

Brick-and-mortar is not out, but with the dramatic YOY increase of mobile shopping, from buying intent to conversion, competitive retailers must deploy a seamless omni-channel strategy. Consumers are evolving with technology, which means retailers must remain cutting edge, creating uncomplicated buying journeys with accessible product information and memorable product experiences.

Email Works

Considering what we know about the cost of inspiring returning customers compared to acquiring new ones (hint: it’s a lot less), email is a valuable way to spend marketing resources leading up to and well before any holiday shopping season. Consumers, for the most part, have already made decisions on what they’re buying during BFCM, so be a part of the research process beforehand with marketing emails that highlight products and holiday specials.

Expect the Unexpected

While every retailer who experienced inventory and technical issues this year may not have suffered as significant a financial loss as Walmart, the damage is not always calculable. These days, frustrated consumers tend to take to social media fairly quickly, and for the most part, the poor reviews are the ones that get shared and remembered. A holiday strategy is only as good as the planning and testing behind it. Furthermore, give consumers opportunities to share their wins. Encourage social sharing throughout the consumer journey with high-fidelity interactive product experiences.

Innovation is Key

Consumers have made it clear they’re looking for a better, easier shopping experience. We’ve left behind the days of newsworthy crowds of people waiting to compete for limited in-store sales. Consumers are opportunistic, which means retailers must be accessible. New technology can and should be leveraged. For retailers, this means replacing 2D product imagery with 3D interactive product experiences. This means deploying augmented reality to bridge the gap between physical and digital shopping encounters, leading to a less complicated path to purchase, and ultimately increased sales.

Ready to learn more? Check out our comprehensive eBook covering Augmented Commerce and why 3D & AR are so compelling.

Not a current customer but ready to get started?

Demo the Platform Today!Already a current customer? Log in to Axis Today!